Alles over Mastercard Corporate Prepaidkaarten

What is a prepaid card?

The prepaid card is preloaded with an amount that can be used for various transactions until the balance is used up. These cards are not linked to a bank account, and unlike a credit card, no monthly repayments are required.

- Application: Start your prepaid card application by submitting the required documents through [email protected].

- Activation: After purchase, your prepaid card will be automatically activated.

- Top-up: Once activated, you can load funds onto the prepaid card. This can be done through a cash deposit or a bank transfer.

- Usage: You can use the prepaid card for purchases online, in stores, or through the Uni5Pay+ App on your mobile phone, just like a debit or credit card.

- Check your balance: With the Uni5Pay+ app, you can easily check the balance of your prepaid card and manage the card.

What are the requirements?

To successfully process your application for the different categories (SME Purchase Card, T&E Company Owned, and Micro Purchase), you must meet the requirements listed below.

SME Purchase Card

- KKF extract

- Articles of Association of the company

- Valid ID card

- Contact details

T&E Company Owned

- KKF extract

- Articles of Association of the company

- Valid ID card

- Contact details

Micro Purchase

- Only a valid ID card or driver's license

- No KKF extract required

Mastercard ID Check

Mastercard ID Check is an authentication method based on the latest authentication standards of the payment networks. It provides additional authentication during online transactions to protect you against unauthorized use of your card. Mastercard ID Check verifies that your online transactions are indeed made by you.

What does this mean for you?

Before an online transaction is processed, you may be asked to verify the transaction through a one-time password (OTP) sent via WhatsApp or SMS to the number registered in our system. This check makes online payments with your prepaid card even safer.

Mastercard ID Check is currently exclusively available for the Mastercard prepaid cards issued by Southern Commercial Bank.

How to apply for a card?

You can apply for a card by submitting the required documents through [email protected]:

- KKF extract

- Articles of Association of the N.V.

- ID of the shareholders as stated in the Articles of Association (Photo of the front and back of the ID).\

- Mobile phone number

- Residential address

- Email address

Top-up

You can top up your prepaid card in two ways.

Bank transfer:

Transfer from your local bank account by following the instructions below.

Beneficiary name | Southern Commercial Bank |

Account number | (USD) 900605 or (SRD) 900600 |

Beneficiary bank | Southern Commercial Bank N.V. |

Description | ID number and the last 4 digits of your card. |

Cash deposit:

You can top up with cash at the following locations:

- Southern Commercial Bank, Tourtonnelaan #33

- Surinaamse Postspaarbank, Paramaribo & Nieuw Nickerie

- Uni5Pay+ Shop, Maagdenstraat #52

Your first payment

How do you make a payment?

- Go to your favorite website and add the desired items to your shopping cart.

- Choose "Check out" and review the items in your shopping cart.

- Enter the address provided by your freight forwarder in the "Shipping address" section.

- Select "Credit or Debit" under the payment methods.

- Enter your card number, name, expiration date, and CVN2 code.

- Click on "Pay"

Your payment has been successfully completed!

Contactless payment

Your prepaid card features a contactless payment symbol, similar to a Wi-Fi symbol. Look for the symbol on the POS device at the point of payment.

To initiate the payment, hold your prepaid card near the symbol on the device. Once the payment is complete, a receipt will be automatically printed.

How to register your Mastercard with PayPal?

- Make sure you have sufficient balance on your Mastercard.

- Go to the website PayPal.com.

- Select Suriname as the 'Country' and enter your mobile number.

- You will receive an SMS with a code. Enter the code.

- Next, enter your address details (Surinamese address).

- Fill in your profile details.

- Your PayPal account has been created.

- Link your Mastercard to your PayPal account by entering your card number, expiration date, and CVN2 code.

- You are registered.

- Now log in to PayPal.com and 'confirm' your card with the 4-digit code from the Uni5Pay+ app.

- Log in to the Uni5Pay+ app to get the 4-digit code (you can find this code in the transaction history of your Mastercard).

- Click 'Confirm' and the shopping can begin!

Your package delivered to Suriname.

How does shipping through a freight forwarder work?

- Join a freight forwarder.

- Receive a foreign address from your freight forwarder.

- Use this as your 'shipping address' when checking out on a website.

- Your package will be delivered to the foreign address, and the freight forwarder will ensure that the package is safely shipped to Suriname.

- The freight forwarder will contact you when your package is available for pickup at their office in Suriname.

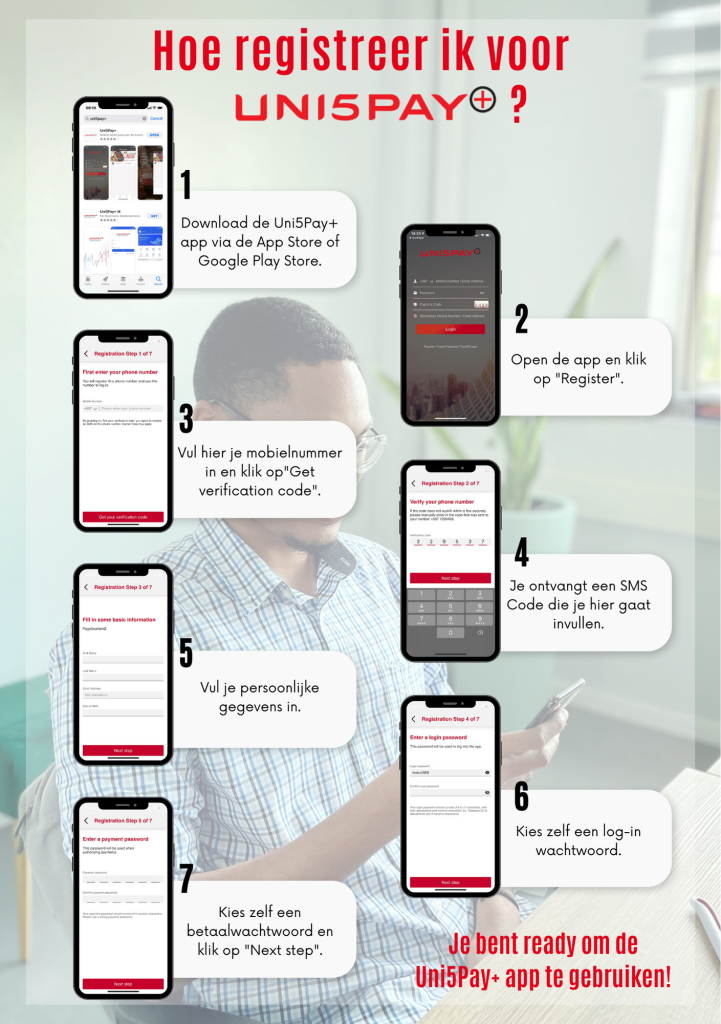

How do you register for Uni5Pay?

- Download the Uni5Pay+ app from the Google Play Store or the App Store.

- Open the Uni5Pay+ app and select 'Register'.

- Enter your mobile number and click on 'Get your verification code'.

- You will receive a 6-digit verification code via SMS.

- Enter the code and click on 'Next step'.

- Then, fill in your personal information and click on 'Next step'.

- Choose a login password (your password should be 8-11 characters long and consist of both alphabetic and numeric characters). Click on 'Next step'.

- Choose a payment password consisting of 6 numeric characters.

- Set up your Face/Touch ID for easier and faster login.

- Log in with your 'login password' and enter the captcha code, or log in using Face/Touch ID.

You are now ready to use the Uni5Pay+ app.

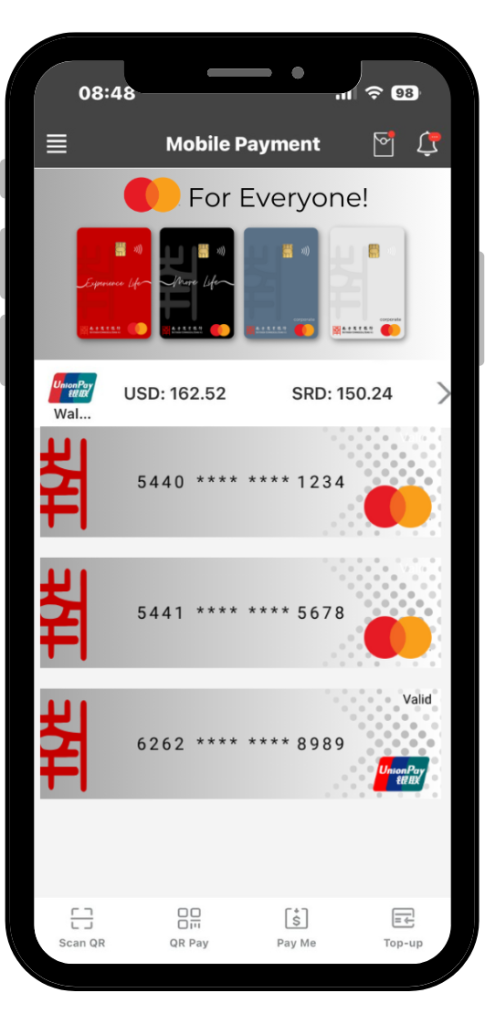

Link your card in the app.

How do you link your card in the Uni5Pay+ app?

- Open the Uni5Pay+ app and log in with your user credentials.

- Go to the menu (top left) and click on 'Add payment card' (the first option in the menu).

- Enter your card number and click on 'Submit'.

- Enter the expiration date of your card.

- Enter your CVN2 code (the 3-digit code on the back of your card).

- Click on 'Send SMS'.

- Enter the SMS code that you received in a text message.

- Your card is now linked to the Uni5Pay+ app!

You can now track your card transactions.

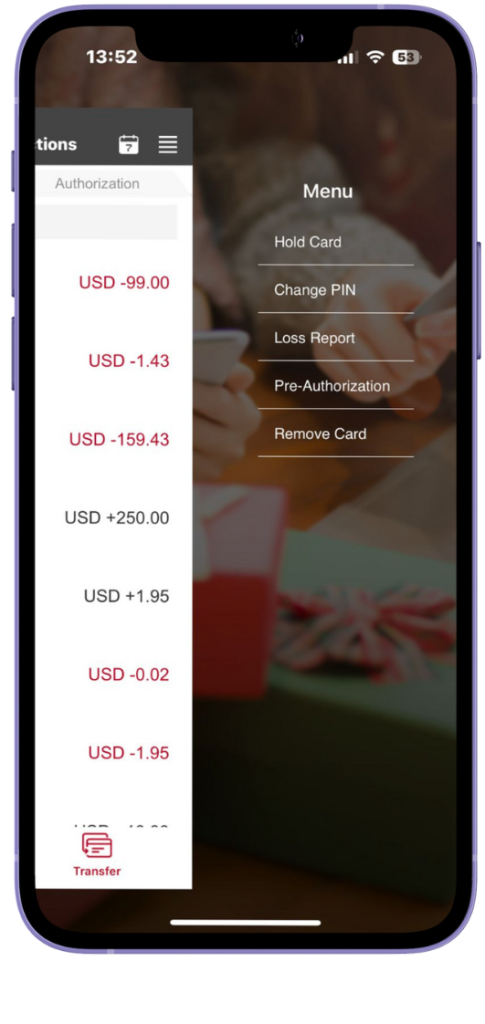

Change your PIN in the Uni5Pay+ app.

How do you change your PIN in the Uni5Pay+ app?

- Log in to the Uni5Pay+ app.

- Click on your linked Mastercard and press again to view the transactions.

- Click on the card menu at the top right.

- Select "Change PIN."

- Enter your old PIN, then enter a new PIN and confirm it.

- Click on "Submit".

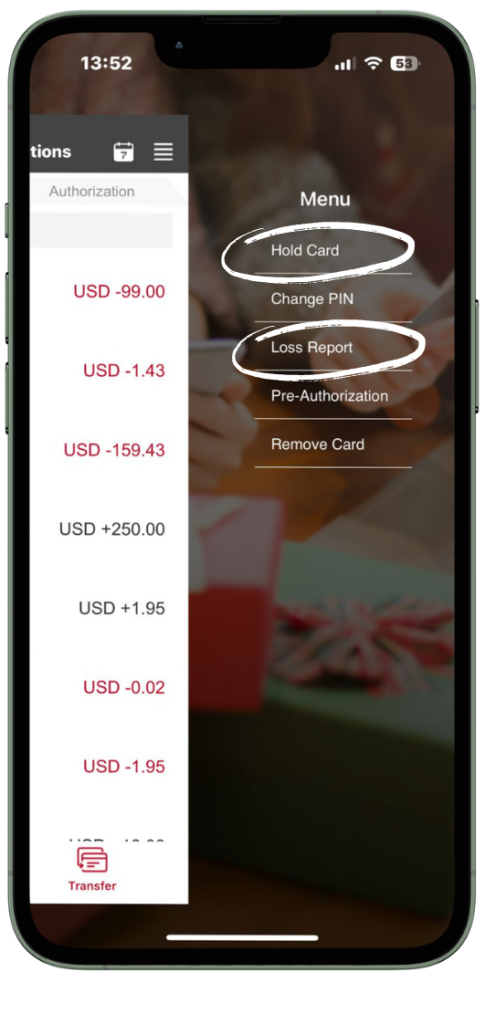

Put your card 'on hold'.

How do you put your card 'on hold' in the Uni5Pay+ app?

- Log in to the Uni5Pay+ app.

- Click on your linked Mastercard and press again to view the transactions.

- Click on the card menu at the top right.

- It will ask 'Are you sure you want to hold this card?

- Enter the captcha code and press "Ok".

- Your card is now put 'on hold'.

Card loss or theft

How do you report the loss of your card in the Uni5Pay+ app?

- Log in to the Uni5Pay+ app.

- Click on your linked Mastercard and press again to view the transactions.

- Click on the card menu at the top right.

- Select 'Loss Report'.

- You will be asked, 'Are you sure to report loss?

- Enter the captcha code and press "Ok".

- Your card is now reported as lost.

Card fees

SME Purchase Card

One-time purchase fee | $ 80 |

Annual fees | $ 60 |

Daily limit for ATM withdrawals | $ 5.000 |

Limit for contactless payments without a PIN | $50 |

Daily limit for contactless payments without a PIN | $200 |

Card limit | $ 50.000 |

Validity period | 5 years |

Micro Purchase

One-time purchase fee | $ 60 |

Annual fees | $ 40 |

Daily limit for ATM withdrawals | $ 2.000 |

Limit for contactless payments without a PIN | $50 |

Daily limit for contactless payments without a PIN | $200 |

Card limit | $ 10.000 |

Validity period | 5 years |

T&E Company Owned

One-time purchase fee | $ 60 |

Annual fees | $ 40 |

Daily limit for ATM withdrawals | $ 5.000 |

Limit for contactless payments without a PIN | $50 |

Daily limit for contactless payments without a PIN | $200 |

Card limit | $ 30.000 |

Validity period | 5 years |

Our Corporate Cards

SME Purchase

Personalized card

Place online orders for your customers and purchase business supplies with the SME Purchase Card. Ideal for everyday business purchases, suitable for the procurement department of small to medium sized businesses, and can also be used for travel expenses.

Who is it meant for?

- Freight Forwarders

- Business owners

- Procurement departments

Costs and fees

One-time purchase fee | $ 80,- |

Annual fees | $ 60,- |

Card limit | $ 50.000,- |

Monthly limit | $ ,- |

Annual limit | $ ,- |

Validity period | 5 years |

Transaction fees | 0.8% |

ATM withdrawal fees | 2% + $ 2,- |

Conversion fees (for non-USD transactions) | 1% |

Micro Purchase

Non-personalized card

Do you have a small Instagram or Facebook shop? Formalize your business by separating your business expenses from your personal expenses with the Micro Purchase card.

Who is it meant for?

- Small entrepreneurs

- Start-up entrepreneurs

- Informal entrepreneurs

- Freelancers

Costs and fees

One-time purchase fee | $ 60,- |

Annual fees | $ 40,- |

Card limit | $ 10.000,- |

Monthly limit | $ 20.000,- |

Annual limit | $ 60.000,- |

Validity period | 5 years |

Transaction fees | 0.8% |

ATM withdrawal fees | 2% + $ 2,- |

Conversion fees (for non-USD transactions) | 1% |

T&E Company Owned

Personalized card

The Company Owned card is requested by the company for executives and employees who frequently travel for business. With this card, you can easily book hotels, rent cars, purchase tickets, and cover expenses during business trips. This card is personalized with the company's name and the cardholder's name.

Who is it meant for?

- Business travelers

Costs and fees

One-time purchase fee | $ 60,- |

Annual fees | $ 40,- |

Card limit | $ 30.000,- |

| Monthly limit | Geen |

| Annual limit | Geen |

Validity period | 5 years |

Transaction fees | 0.9% |

ATM withdrawal fees | 2% + $ 2,- |

Conversion fees (for non-USD transactions) | 1% |

Card transaction fees

SME Purchase

Cross-border transaction fees | 0.8% |

Conversion fees | 1% |

ATM withdrawal fees | $ 2,- + 2% |

Micro Purchase

Cross-border transaction fees | 0.90% |

Conversion fees | 1% |

ATM withdrawal fees | $2,- + 2% |

T&E Company Owned

Cross-border transaction fees | 0.9% |

Conversion fees | 1% |

ATM withdrawal fees | $2,- + 2% |

What are cross-border transaction fees?

These are fees charged for all transactions that take place outside of Suriname. The Cross-Border transaction fees vary per Mastercard prepaid card.

What are conversion fees?

These are fees charged for all transactions where the transaction currency and the card currency (USD) do not match. The conversion fees amount to 1% of the amount to be paid. For example: If you order an item in EURO on a Dutch website and your card currency is USD, the conversion fees will apply.

What are ATM withdrawal fees?

These are fees charged when you withdraw cash from an ATM.

Additional reservations

What are additional reservations?

In the context of prepaid cards, "additional holds" typically refer to temporary reservations of the available balance on the card. This ensures that the costs of a transaction or any potential additional charges can be covered.

What does this mean for you?

In the case of the Mastercard cards issued by Southern Commercial Bank, temporary holds are only placed on the balance of your card for restaurant transactions and cross-currency transactions.

- The restaurant transaction holds amount to 30% of the total payment amount.

- The cross-currency transaction holds amount to 5% of the total payment amount.

What is a cross-currency hold?

A cross-currency hold is an additional reservation applied when there is a difference in the transaction currency.

Release of holds:

These holds are temporary, and the actual amount charged to your prepaid card will be adjusted to reflect the final transaction amount. However, the release of these held amounts may take some time, and the funds may not be immediately available for other transactions.

It is important to be aware of these waiting times when using a prepaid card, as they may affect the available balance for other transactions. Additionally, the policies regarding "additional holds" may vary between restaurants.

Example of additional restaurant holds:

Transaction amount | USD 100 |

Cross-border transaction fees: 0.9% x USD 100 | USD 0.90 |

Additional hold: 30% x USD 100 | USD 30 |

Total | USD 130.90 |

Example of additional holds for cross-currency transactions:

Transaction amount in USD | EU 100 X 1.10= | USD 110 |

The charges that are applied | 0.90% CBTF + 1.00% Conversion (0.009 x $110) + (0.01 X $110)= | USD 2.09 |

Additional hold | 5% x USD 110= | USD 5.50 |

Total | USD 117.59 |

Mastercard Easy Savings

The Mastercard Easy Savings program applies to all Corporate Mastercard prepaid cards issued by Southern Commercial Bank. This program offers discounts on purchases at participating websites, hotels, restaurants, and gas stations when you use your Corporate Mastercard prepaid card. The Mastercard Easy Savings program is completely free, meaning there are no additional costs for you as the cardholder.

You can view the participating websites, hotels, restaurants, and gas stations, as well as the available discounts, by visiting the Mastercard Easy Savings program website. By entering the city, state, or postal code of your destination, you can search for the discounts currently available for fuel, hotels, and dining establishments.

Note: offers may change at any time without prior notice.

Current Easy Savings offers include:

- Hotels: Save 4% on a stay at one of the 6,000 participating hotels, including Comfort®, Holiday Inn, Hampton Inn, Marriott, and Hilton.

- Restaurants: Save 4% on dining at over 20,000 restaurants, including selected locations of Outback Steakhouse & Pizza Hut.

- Business products and services: Save 2% to 25% on business products and services that offer business support, such as Microsoft Advertising.

- Fuel and maintenance: Save 1% on fuel at over 19,000 participating gas stations, including Shell, BP, and Exxon Mobil.

Visit the website for the most up-to-date Easy Savings offers.